Depreciation recapture formula

Depreciation recapture allows the IRS to collect taxes on the sale of an asset that a business had previously used to offset its taxable income through wear tear and operating expenses. Request A Demo Today.

How To Use Rental Property Depreciation To Your Advantage

Schedule C Form 1040 Profit or Loss From.

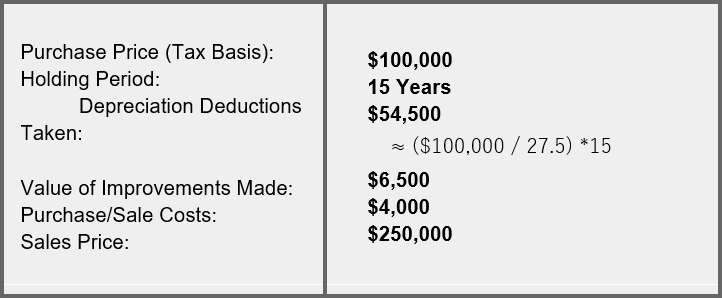

. 3 Now subtract the total depreciation expense claimed from the original purchase price of the property to determine. Below well outline how depreciation recapture is calculated or recaptured and how investors can use a 1031 exchange to defer recapture taxes on their investment properties. Example of Depreciation Recapture.

Section 1245 depreciation recapture is used to calculate any income tax or capital gains tax you may owe on a sold asset. You can claim business use of an automobile on. To calculate this you will.

Depreciation recapture is a process that allows the IRS to collect taxes on the financial gain a taxpayer earns from the sale of an asset. However the gain equal to the recapture income is reported in full in the year of the sale. You may be able to deduct the acquisition cost of a computer purchased for business use in several ways.

In this situation the UCC is also 6000 10000 - 4000. Examples of Depreciation Recapture. Minimizing Tax Through Transaction Planning Michael Plaks Enrolled Agent REI Tax Firm.

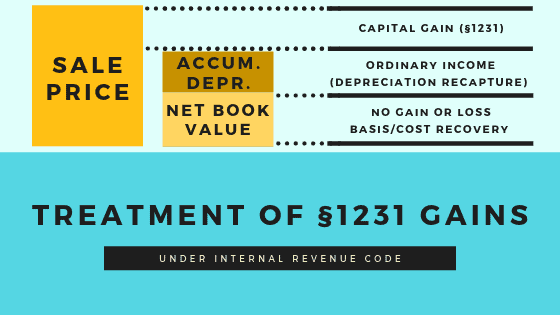

Reduce Risk Drive Efficiency. Ad With Decades Of Experience Let Cornerstone Help With Securitized 1031 Replacement Today. Section 1250 depreciation which is deducted over 39 years using the straight-line method will generate accumulated depreciation over the years.

See it In Action. Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your. Section 1245 Depreciation Recapture.

Finally it explains when and how to recapture MACRS depreciation. This is a rare occurrence because the IRS. Request A Demo Today.

Reduce Risk Drive Efficiency. 1250 gain of 20 the lesser of the additional depreciation 20 or gain on the property 150. Depreciation recapture tax rates.

ABC Industrial buys equipment for 20000 which ABC then depreciates over the following four years at the rate of 2000 per year. The depreciation method used was a 39-year straight-line method. If you use this method you need to figure depreciation for the vehicle.

Ad A Description of the Types of Property Subject to Depreciation Recapture. See it In Action. The tax rate for the depreciation recapture will depend on whether an asset is a section 1245 or 1250 asset.

Ad A Description of the Types of Property Subject to Depreciation Recapture. The recapture income is also included in Part I of Form 6252. Recaptured Depreciation Example.

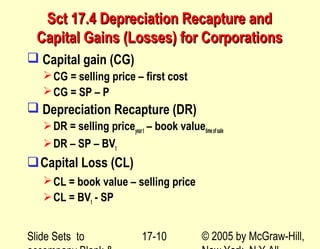

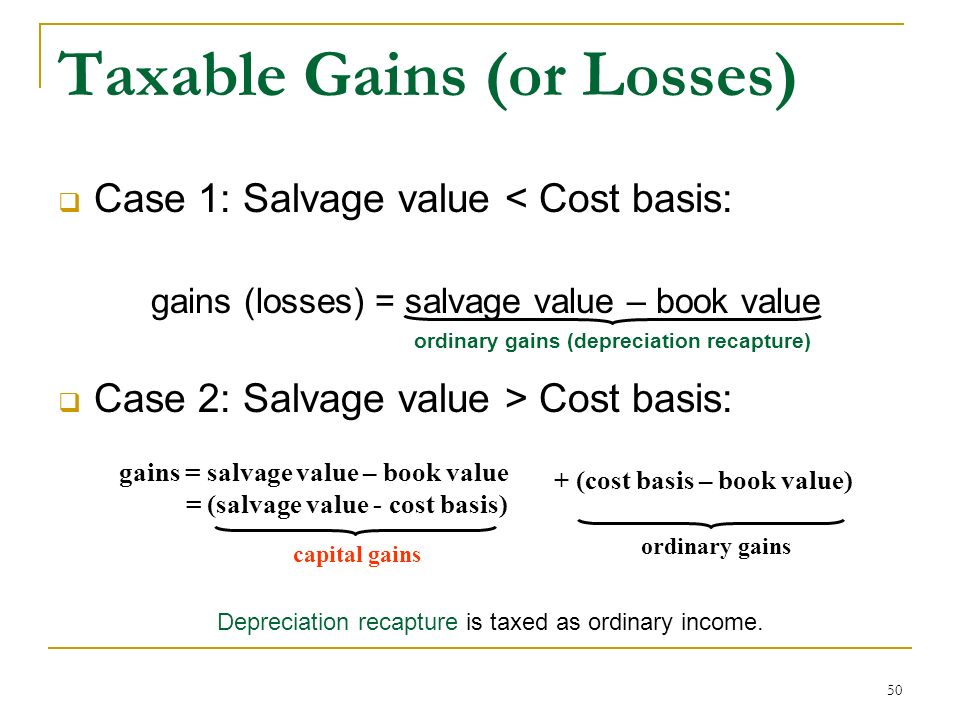

The remaining gain of 130 would be broken. Calculating Depreciation Recapture Under IRC 1245 and 1250. What Is Depreciation Recapture.

A change in the depreciation method period of recovery or convention of a depreciable asset. He subtracts 10000 the lesser of the proceeds of disposition of the property minus the related outlays and expenses. Useful Items You may.

Only the gain greater than the. In order to understand about this concept one should look at the example of recaptured depreciation suppose a company has purchased. Partnership AB recognizes Sec.

Depreciation recapture is associated with the depreciable property and selling the depreciable property results in the ordinary income and reduces the. Under Internal Revenue Code section 179 you can expense the acquisition. Cornerstone Combines The Power Of 1031 Securitized Real Estate.

Like Kind Exchanges Of Real Property Journal Of Accountancy

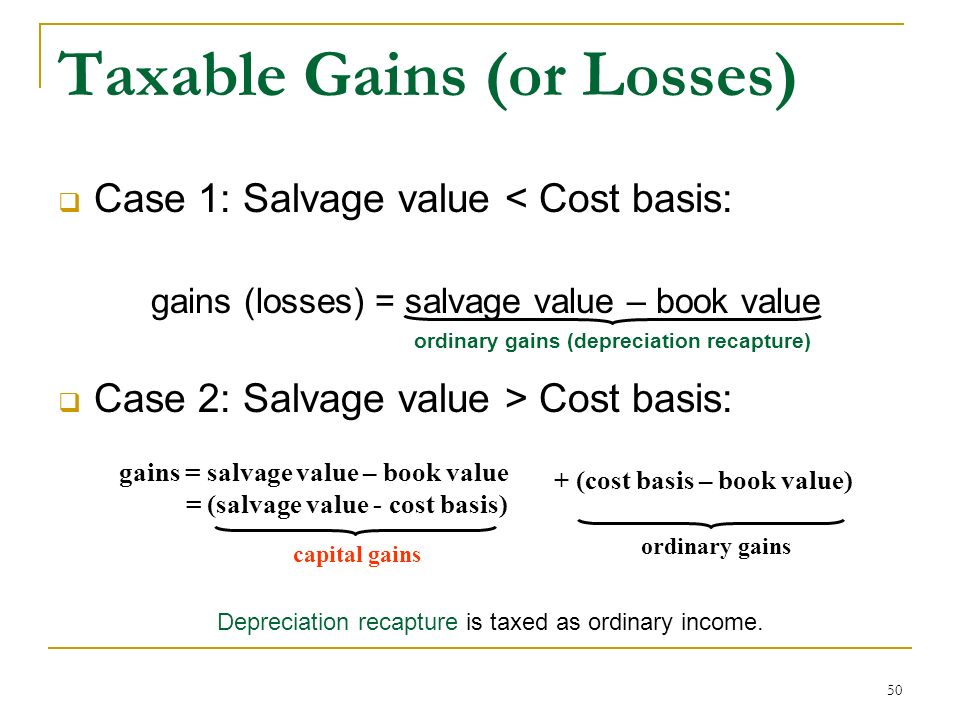

Chapter 17 After Tax Economic Analysis

Chapter 8 Depreciation And Income Taxes N Asset

1031 Exchange And Depreciation Recapture Explained A To Z Propertycashin

Chapter 8 Depreciation And Income Taxes Ppt Video Online Download

Capital Gains And Losses Sections 1231 1245 And 1250

Contributed Property In The Hands Of A Partnership

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Learn About Depreciation Recapture Spartan Invest

Chapter 8 Depreciation And Income Taxes N Asset

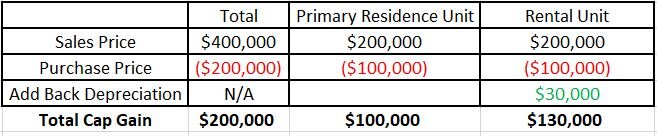

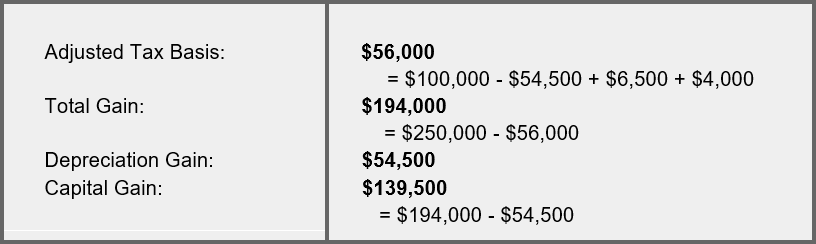

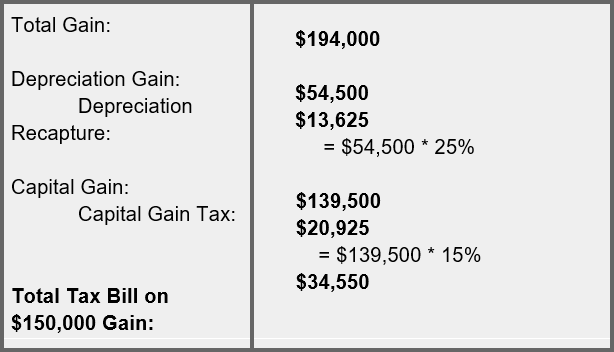

Do I Have To Pay Tax When I Sell My House Greenbush Financial Group

Learn About Depreciation Recapture Spartan Invest

Property Dispositions Ppt Download

Learn About Depreciation Recapture Spartan Invest

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download

Depreciation Starting With The Basics Ilsoyadvisor

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download