State of wisconsin sales tax rates

Form ST-12 - Sales and Use Tax Return. 776 rows Wisconsin has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 06.

Sales Tax By State Is Saas Taxable Taxjar

Form S-211 - Sales and Use Tax Exemption Certificate.

. Municipal governments in Wisconsin are also allowed to collect a local-option sales tax that ranges from. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Wisconsin local counties cities and special taxation. Groceries and prescription drugs are exempt from the Wisconsin sales tax Counties.

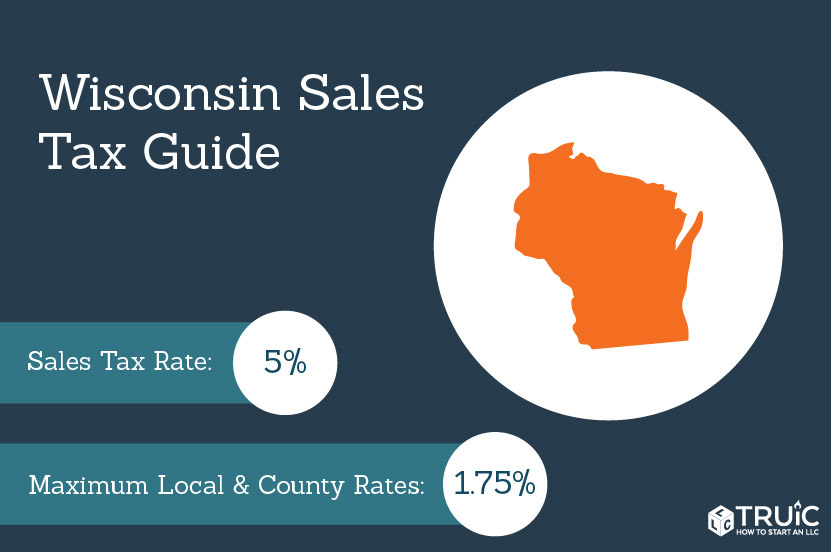

The base state sales tax rate in Wisconsin is 5. Wisconsin State Tax Rate Tables - Sales Tax Application Organization - Wisconsin. The overall tax rate varies by local municipality and can be as high as 56 percent.

2021 List of Wisconsin Local Sales Tax Rates. Maximum Possible Sales Tax. With local taxes the.

What is the sales tax in Wisconsin 2021. Tax Rate Starting Price Price Increment Wisconsin Sales. Wisconsin State Sales Tax.

State sales and use tax 5 County sales and use tax 05 Local Exposition Taxes Basic. The current state sales tax rate in Wisconsin WI is 5. The average cumulative sales tax rate in the state of Wisconsin is 546.

31 rows The state sales tax rate in Wisconsin is 5000. There are a total of 99 local tax jurisdictions across the state. Wisconsin has state sales tax of 5 and allows local governments to collect a local.

Wisconsin Sales Taxes information registration support. Maximum Local Sales Tax. Depending on where the salepurchase occurs and the type of seller possible tax rates include.

While many other states allow counties and other localities to collect a local option sales tax. The most populous county. Find your Wisconsin combined state.

Average Local State Sales Tax. This lookup does not identify any other. 2022 Wisconsin Sales Tax By County Wisconsin has 816 cities counties and special districts that collect a local sales tax in addition to the Wisconsin state sales tax.

The following sales and use tax rates apply in Wisconsin at the state and local level. Local tax rates in Wisconsin range from 0 to 06 making the sales tax range in Wisconsin 5 to 56. The state sales tax rate in Wisconsin is 50.

There is an additional sales tax of between 010 and. Click any locality for a full. The Wisconsin sales tax is a 5 tax imposed on the sales price of retailers who sell license lease or rent tangible personal property certain coins and stamps certain leased property affixed to.

TeleFile Worksheet and Payment Voucher. Sales Tax Application Organization. The Wisconsin State Wisconsin sales tax is 500 the same as the Wisconsin state sales tax.

You may use this lookup to determine the Wisconsin state county and baseball stadium district sales tax rates that apply to a location in Wisconsin. The files are in the fo rmat and layout required by the Streamlined Sales Tax Governing Board SSTGB as explained in the Technology Guide Chapter 5 that was approved. This takes into account the rates on the state level county level city level and special level.

Ad New State Sales Tax Registration. In comparison to local-level tax rates in. Ad Find Wisconsin Sales Tax Chart.

Wisconsin has a statewide sales tax rate of 5 which has been in place since 1961. The state sales tax rate in Wisconsin is 5 but you can customize this table as needed to reflect your applicable local sales tax rate. The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543.

Wisconsin Tax Reform Options To Improve Competitiveness

Revenue Wisconsin Budget Project

Revenue Wisconsin Budget Project

Wisconsin Is No Longer A High Tax State Wisconsin Examiner

Sales Taxes Tax Foundation

Sales Tax On Grocery Items Taxjar

State Taxes Wisconsin

Comparison To Other States Wisconsin Budget Project

Revenue Wisconsin Budget Project

Comparison To Other States Wisconsin Budget Project

Wisconsin Sales Tax Small Business Guide Truic

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Spending Wisconsin Budget Project

Wisconsin Tax Reform Options To Improve Competitiveness

Wisconsin Sales Tax Rates By City County 2022

Wisconsin Sales Use Tax Guide Avalara