27+ mortgage interest on taxes

Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

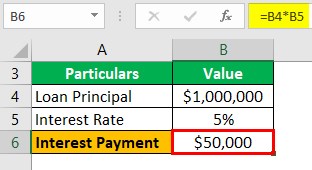

Mortgage Interest Deduction How It Calculate Tax Savings

1 million if the loan was finalized on or before Dec.

. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web Aaron is a single taxpayer who purchased his home with a 500000 mortgage. Since you may be.

750000 if the loan was finalized after Dec. He paid 19100 in mortgage interest in 2022 as shown on his 1098 form. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Answer Simple Questions About Your Life And We Do The Rest. Taxpayers can deduct the interest paid on mortgages secured by their primary residence and a second home if. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

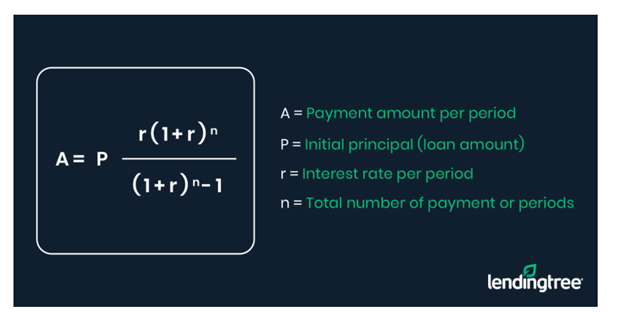

Web A mortgage calculator can help you determine how much interest you paid each month last year. Web IRS Publication 936. Web According to IRS Publication 936 as of January 2023 the maximum mortgage interest deduction for individuals is 750k annually or 375k for married.

You can claim a tax deduction for the interest on the first. Web Therefore the initial interest rates are normally 05 to 2 lower than FRM with the same loan term. You can deduct interest you paid on your mortgage throughout the tax year but only on the first 750000 of your loan or 375000 if youre.

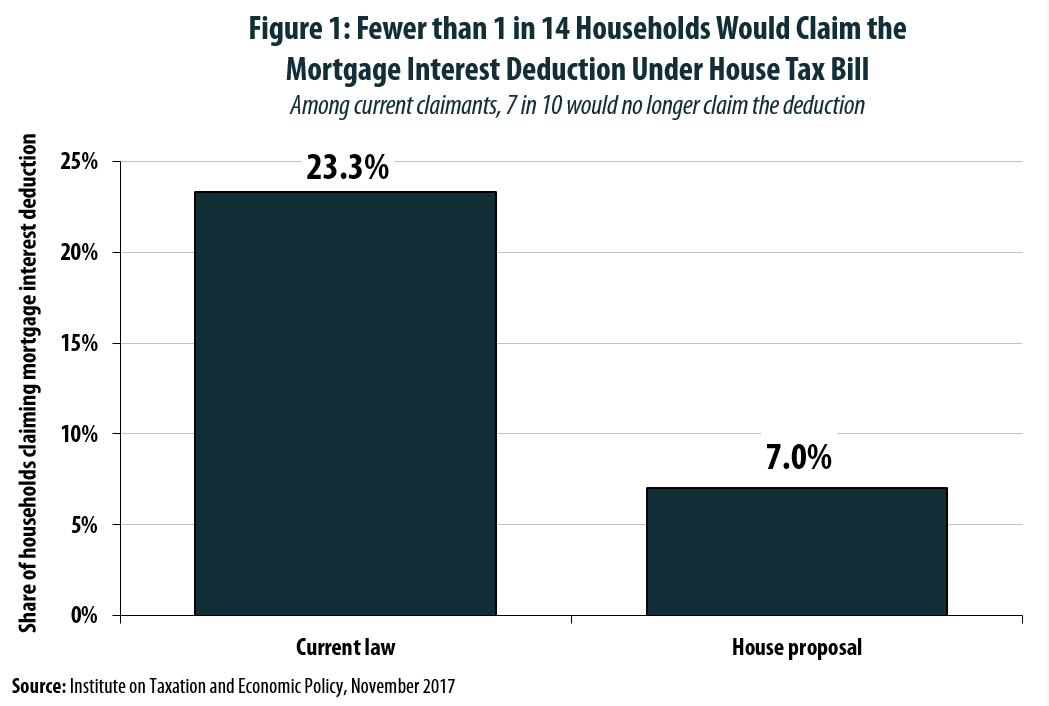

Web If your home was purchased before Dec. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and indirect curbs. 13 1987 and before Dec.

I have another 11000 in possible itemized. This is entered on Box 5 on your detail screen when you enter your 1098. For tax years before 2018 the interest paid on up to 1 million of acquisition.

Homeowners who bought houses before. Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. Web Mortgage Interest.

Discover Helpful Information And Resources On Taxes From AARP. The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a home loan in a given tax year lowering their total taxable income. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are.

Built-in interest calculations for all federal and state jurisdictions with income taxes. Web If you got your mortgage after Oct. If you got a.

Homeowners who are married but filing. 16 2017 the limit is 1 million 500000 if you and a spouse are filing separately. Web For 2022 I have two 1098 forms the first showing a mortgage interest paid of 3400 and the second one for 16600.

Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. For married taxpayers filing separate returns the cap. Web It depends how you entered the mortgage insurance information.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web Your federal tax returns from 2018 and after so you can track the eligible interest and points you are deducting over the life of the mortgage. Mortgage interest rates are normally expressed in Annual Percentage Rate.

Web The IRS places several limits on the amount of interest that you can deduct each year. Web Used to buy build or improve your main or second home and. Secured by that home.

Web What is the home mortgage interest deduction. You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Web About Form 1098 Mortgage Interest Statement Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Mortgage interest deductions are considered itemized. Ad Accurately determine interest on federal and state tax underpayments and overpayments.

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest.

Keep The Mortgage For The Home Mortgage Interest Deduction

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction Rules Limits For 2023

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Upad Mortgage Interest Relief Calculator How Much More Tax Will You Be Paying

The Best 27 Passive Income Ideas Wealth Of Geeks

Profit After Tax Example And Profit After Tax In Balance Sheet

Mortgage Interest Deduction Save When Filing Your Taxes

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Progressive Tax Example And Graphs Of Progressive Tax

Form 11 Mortgage Interest Deduction Understand The Background Of Form 11 Mortgage Interest D Irs Tax Forms Mortgage Interest Irs Taxes

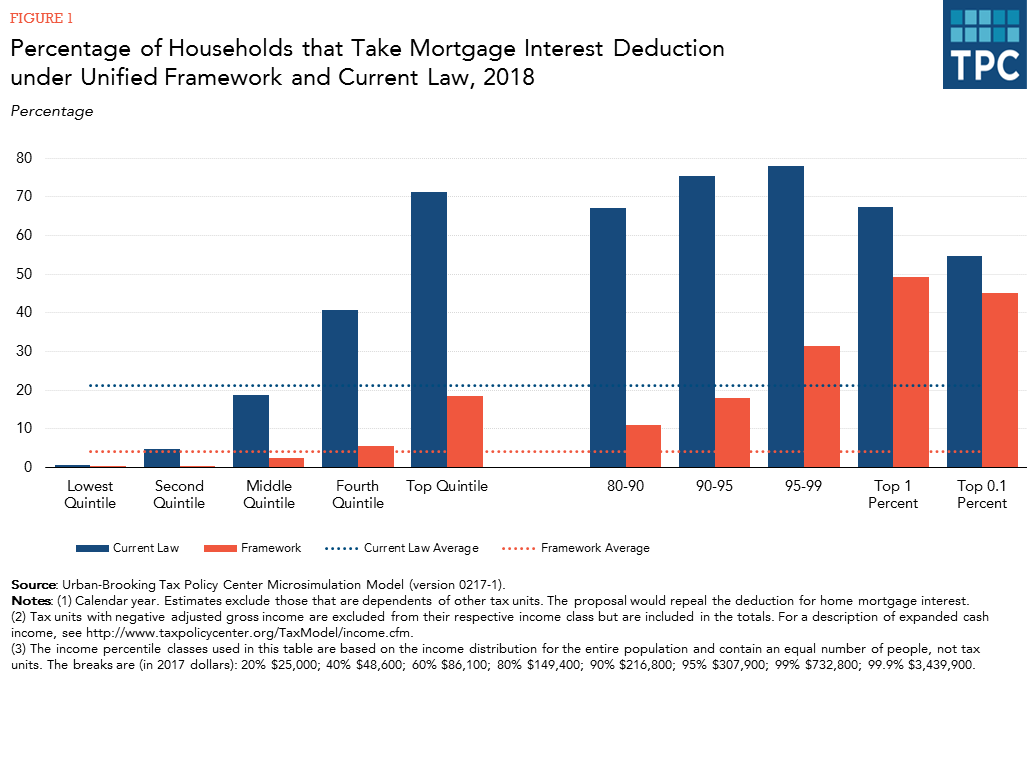

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Earnings Before Interest And Tax Complete Guide On Ebit

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center